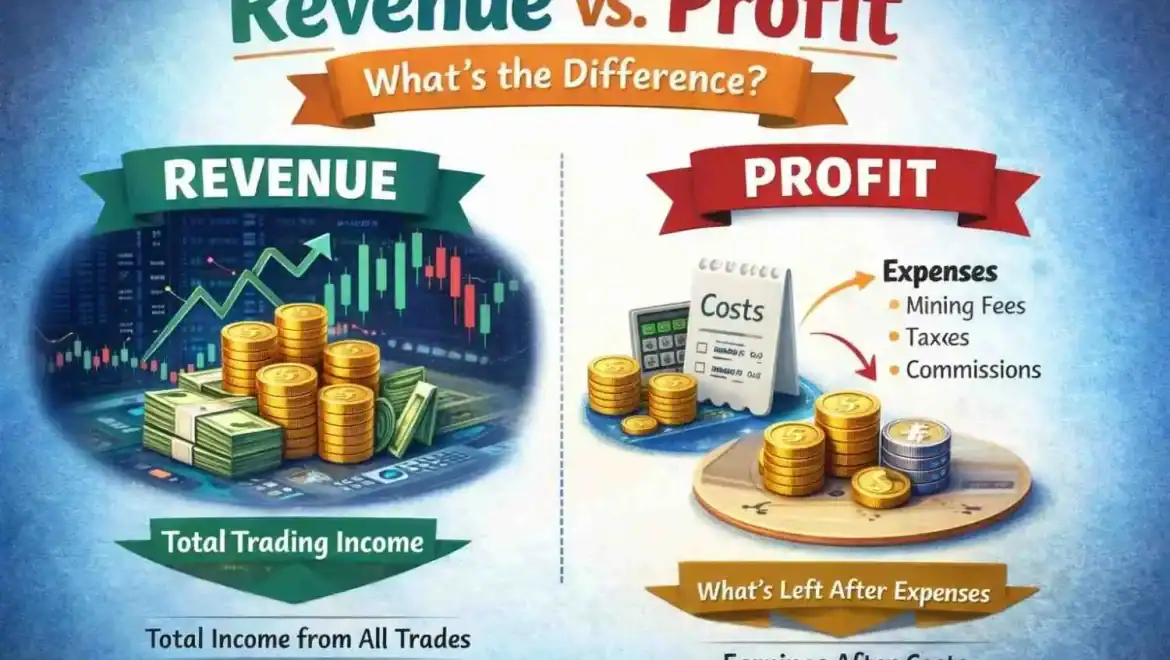

In crypto, finance, and trading, many people confuse income terms. The debate around revenue vs profit becomes more complex when markets move fast and prices change daily. Clear understanding protects traders from costly mistakes. Revenue shows total earnings from activity. Profit shows what remains after every cost, loss, and fee. This difference becomes critical in digital finance.

Need To Know About Dual Currency Investment

What Is Revenue vs Profit in Crypto Trading and Finance

In crypto trading and finance, profit versus revenue explains the difference between money earned and money kept. Revenue is the total value gained from trades, investments, or financial activities before costs are removed. It includes winning trades, staking rewards, interest income, or transaction-based earnings. Revenue looks attractive during high market activity but does not reflect true performance.

Additional Info

Profit shows the real outcome after subtracting all costs. These costs include trading fees, gas fees, slippage, losses from bad trades, and taxes. In crypto markets, prices move fast, and expenses add up quickly. This is why traders may report high revenue while still ending with low or negative profit.

How Revenue Works in Crypto and Trading

In crypto trading, revenue usually comes from selling assets at higher prices. It may also come from trading volume, staking rewards, or platform fees. Revenue looks attractive during bull markets. However, revenue does not include gas fees, exchange charges, or losses. Many traders see high revenue but forget to calculate real outcomes.

Why Profit Is the Real Measure in Crypto

Profit in crypto reflects true financial success. It subtracts trading fees, network costs, taxes, and losses. Without profit, revenue numbers are meaningless. This is why revenue and profit matters more in crypto than traditional business. High volatility can erase revenue quickly.

Financial Services

In finance companies, revenue comes from interest, commissions, and service fees. Banks and funds often report large revenue numbers. These numbers attract attention but hide internal costs. Profit shows how efficiently a company manages risk, staff, and operations. Investors rely on profit to judge long-term stability.

Trading Revenue vs Trading Profit

Trading revenue means total gains from successful trades. It ignores losing trades and hidden costs. Many beginners celebrate revenue without checking final results.

Trading profit includes wins, losses, fees, and slippage. Serious traders track profit daily because it reflects true performance.

| Cost Type | Impact on Profit |

|---|---|

| Trading fees | Reduce every transaction |

| Gas fees | Increase blockchain costs |

| Slippage | Lowers expected returns |

| Taxes | Cut net earnings |

Why Revenue Mean Losses

Many traders experience high revenue during active trading. Frequent buying and selling increases revenue numbers. However, fees and bad timing reduce profit. A trader can generate large revenue and still lose money. Profit reveals whether the strategy truly works.

Crypto Projects

Crypto projects earn revenue through token sales, transaction fees, and services. High revenue creates hype and market attention. However, expenses like development and security reduce profit. Smart investors look at profit sustainability, not hype. Long-term value depends on profit control.

Profit Margins

Profit margin shows how much profit remains from revenue. Higher margins mean better efficiency and risk control. In trading, margins fluctuate based on market conditions. Revenue vs Profit margins.

| Revenue | Profit | Margin |

|---|---|---|

| 50,000 | 5,000 | 10% |

| 100,000 | 4,000 | 4% |

Traders Focus

Professional traders design strategies around profit, not revenue. They limit trades, manage risk, and reduce fees. This approach protects capital. Understanding revenue and profit helps traders survive bear markets. Profit discipline separates professionals from gamblers.

For Investors

Investors analyse both numbers before committing funds. Revenue shows growth potential, while profit shows business strength. Both metrics together create trust. In crypto investments, profit stability matters more than fast revenue growth.

Long-Term Success

Revenue creates opportunity, but profit creates sustainability. Businesses and traders who ignore profit eventually fail. Profit supports reinvestment and stability.

Market Volatility

Crypto markets move faster than traditional finance markets. Price swings can inflate revenue during short rallies. However, sudden drops often erase profits within minutes. Volatility makes revenue unstable. Profit depends on timing, discipline, and exit strategy rather than market hype.

Trading and Derivatives

Spot trading revenue comes from buying low and selling high. Derivatives trading creates revenue through leverage and short positions. Both methods can show large revenue numbers quickly. Profit differs because leverage increases risk and fees. Many traders see high revenue in derivatives while losses remove profit completely.

Long-Term Profitability

Fees play a silent but powerful role in crypto trading. Exchanges charge fees on entry, exit, and sometimes holding positions. These fees slowly drain profit. Revenue ignores these charges. Profit reveals how fees impact overall performance over time.

Emotional Trading

Emotions increase trading activity. Fear and greed push traders to overtrade during market moves. This behaviour increases revenue but damages profit. Profit improves when traders stay patient. Fewer, well-planned trades protect capital and reduce losses. This Why you have to know difference between Revenue vs Profit.

How Tax Rules Change Net Profit in Crypto

Crypto taxes vary by region and trading activity. Taxes apply to realized gains, not revenue. Many traders forget this detail until tax season arrives. Profit must include tax deductions. Ignoring taxes creates false confidence and financial risk.

Start-ups

Crypto platforms earn revenue from transaction fees, subscriptions, and services. High usage increases revenue quickly. However, security, development, and compliance costs reduce profit. Investors study profit sustainability. Revenue growth without profit often signals future instability.

Risk Management

Risk management focuses on limiting losses rather than chasing gains. Stop losses, position sizing, and diversification protect profit. Revenue does not account for risk exposure. Profit reflects smart risk control. This difference explains why disciplined traders outperform active traders long term.

Beats Revenue Spikes

One-time revenue spikes attract attention but do not guarantee success. Consistent profit shows skill and stability. Professional traders aim for steady growth. Understanding this mindset strengthens long-term performance. It shifts focus from excitement to discipline.

Need To Know About How to Sell Coin Collection

Conclusion

Understanding revenue vs profit in crypto, finance, and trading is essential for smart decision-making. Revenue shows activity and growth, but profit reveals real success. In fast-moving markets, high revenue can disappear quickly without cost control. Traders, investors, and businesses must focus on profit to survive volatility and build long-term wealth. When you clearly understand this, you gain the ability to judge performance accurately, avoid emotional decisions, and protect your capital in uncertain markets.

0 comments

Write a comment